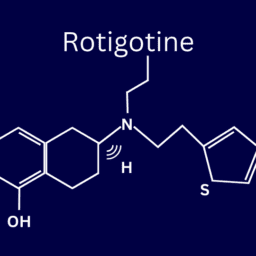

For more than 17 years, the Davis Phinney Foundation has been helping people with Parkinson’s live well today. This means supporting cutting-edge quality of life research to inform our programs and making important educational resources accessible to people with Parkinson’s and their families, care partners, and loved ones.

One concrete way to show up for the people and causes you love is to make a plan for them in your will, and we hope to make this vital task more widely accessible to those who need it. If you don’t have an up-to-date will, you can use the Davis Phinney Foundation’s tool to create yours and even include an optional legacy gift in the process.

No matter your age or circumstances, everyone needs a legal will to plan for the future and make a lasting commitment to the people and causes that matter most. Making a will is crucial to protecting your loved ones and taking responsibility for your assets.

While making a will doesn’t have to be complicated or scary, many people avoid the task because they assume it will be. But this FreeWill-writing tool makes the process easy, intuitive, and fast: in less than 20 minutes, you can make a will and plan for the future. You won’t need to submit any sensitive personal information — no social security number necessary, for example — and you’ll finish with a PDF of your will that is legally valid in all 50 states.

If you’re interested, creating a legacy with the Davis Phinney Foundation is the most powerful way to support our resources, research, and community for generations to come. It represents your lasting commitment to ensuring people live well with Parkinson’s today while costing you nothing.

Get started on your FreeWill today!

FreeWill is a team of over 150 strategists, lawyers, and fundraisers committed to making the estate planning process more accessible for all. FreeWill’s security policies can be found here. FreeWill can also be used with more complicated estates by creating a list of documented wishes that can be brought to an attorney, saving you time and money.

And, if you’re looking for another way to give to the Davis Phinney Foundation, consider giving through your Qualified Charitable Distributions (QCD) to support our work and your taxes!

Donors 70.5 and older with a traditional IRA are eligible to benefit from making a gift from their IRA! In many cases, these gifts, also known as QCDs, are 100% tax-free and can potentially impact your 2022 taxes.

For donors 72 and older, the impact can go even further! QCDs also count towards your Required Minimum Distribution (RMD) without the taxes associated with regular IRA withdrawals. Many donors choose to give QCD gifts earlier in the year to ensure their gifts count toward an RMD, even if they plan to donate to charity later in the year. Also, QCDs make an immediate impact: First and foremost, we will put your IRA gift to support our mission and the key initiatives you care about.

To help make the process and paperwork simple, we have a free and secure online tool: a simple platform highlighting some of the benefits of IRA giving. And, if you’re ready to make an impact, helps you make your gift in just a few minutes.

Make a gift from your IRA today!

I hope you consider using these free, secure resources from our friends at FreeWill to support the mission you know well. Thank you for your continued support.

If you have any further questions about FreeWill or Planned Giving at the Davis Phinney Foundation, please contact Claire Herritz at 303-953-4978 or legacy@dpf.org.

*FreeWill offers online self-help solutions for common estate planning needs and related educational content. Estate planning may involve state and federal laws, and estate planning needs will differ based on personal circumstances and applicable laws. FreeWill is not a law firm; its services are not substitutes for an attorney’s advice. The Davis Phinney Foundation recommends consulting a financial or tax advisor with any specific questions about how IRA giving may impact your personal situation.