As the year winds down, many of our supporters are celebrating with family and friends and supporting the causes they love during this season of giving. If you’re looking for a tax-savvy way to make a significant impact with the Davis Phinney Foundation, consider giving from your IRA!

If you are 70.5 or older and have a traditional IRA, you can donate directly from your IRA and join many donors who are shifting away from cash donations to have a greater impact at less cost. These gifts are generally tax-free, aren’t recognized as income, and may reduce your future tax bill—all while helping people live well with Parkinson’s.

Also, if you are 72 or older, you can fulfill your Required Minimum Distribution (RMD) for this year. You may be required to remove a certain amount from your IRA each year, or else face a hefty tax penalty. A donation to the Davis Phinney Foundation can help you compassionately fulfill your RMD.

You can use our secure online tool to donate directly from your account to support the Davis Phinney Foundation, learn more about giving from your IRA, or request a tax acknowledgement letter for an IRA gift you’ve already made.

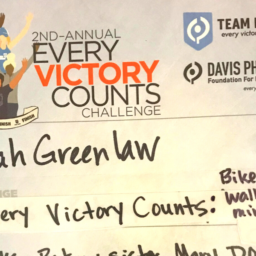

One of our dedicated supporters, Bo Davis, shared his experience giving from his IRA, and his exchange with his financial advisor:

“It’s better for the donor than a traditional charitable deduction because it prevents ordinary income from reaching your tax return at all. It’s effectively an ‘above-the-line deduction,’ whereas a traditional charitable deduction is a ‘below-the-line deduction.’

This means that other things which are based off of your adjusted gross income (such as Medicare costs, tax credit and deduction phaseouts, etc.) end up better off with the QCD.

Also, it’s easy — I don’t have to write and mail checks. And it’s painless — I have to take the RMD anyway.”

Bo’s experience in giving an IRA gift has been easy and beneficial to the Davis Phinney Foundation and to Bo’s finances. If you would like to join Bo and support some of the most important programs, research, tools and resources for people living with Parkinson’s, give from your IRA today.

Get in Touch

If you have any questions about IRA contributions, planned giving, or other ways to donate to our mission, please contact Rich Cook at rcook@dpf.org.